By Kylie Wright

This is the second of a multi-part series from B3 on the relationship between seismicity and the water management business. Here we discuss the regulatory environment surrounding induced seismicity in the oilfield and the related implications for water management.

MANAGING SEISMICITY THROUGH LEGISLATION

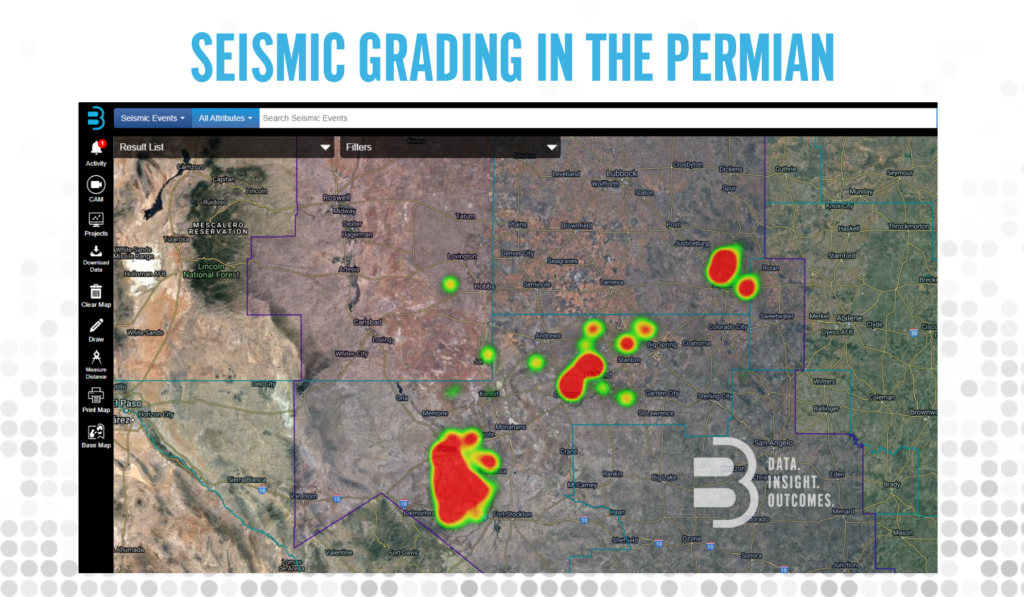

The increasing magnitude, frequency, and geographic impact of seismicity across the Permian has significant implications as seismic trends have been the primary driver for recent legislation limiting the development of new disposal capacity. The legislative process is ever-evolving, especially in TX, where most of the recent change in Permian seismic activity has occurred. As recently as early September 2021, the Railroad Commission of Texas (RRC) has proposed new legislative hurdles to disposal development with an eye toward managing seismicity. The NM Oil Conservation Division (NM OCD) has also recently stated that it is working with other NM state agencies and stakeholders to develop a process addressing disposal in areas with seismic risk. According to the NM OCD, this process includes the potential for reduction in injection volumes, alterations of disposal well depths, and complete well shut-ins. NM currently permits a very limited number of disposal wells in the Delaware Mountain Group formation and is predominantly permitting only “deep” disposal wells outside of this formation. This represents an emerging discrepancy between TX and NM UIC permitting strategies, where NM favors deep over shallow disposal while the opposite is true of TX. Overall, NM has permitted many fewer disposal wells relative to production than neighboring TX. Importantly, this indicates that large volumes of NM’s produced water and induced seismic risk are exported across state lines.

Increasing Seismicity and Decreasing Capacity

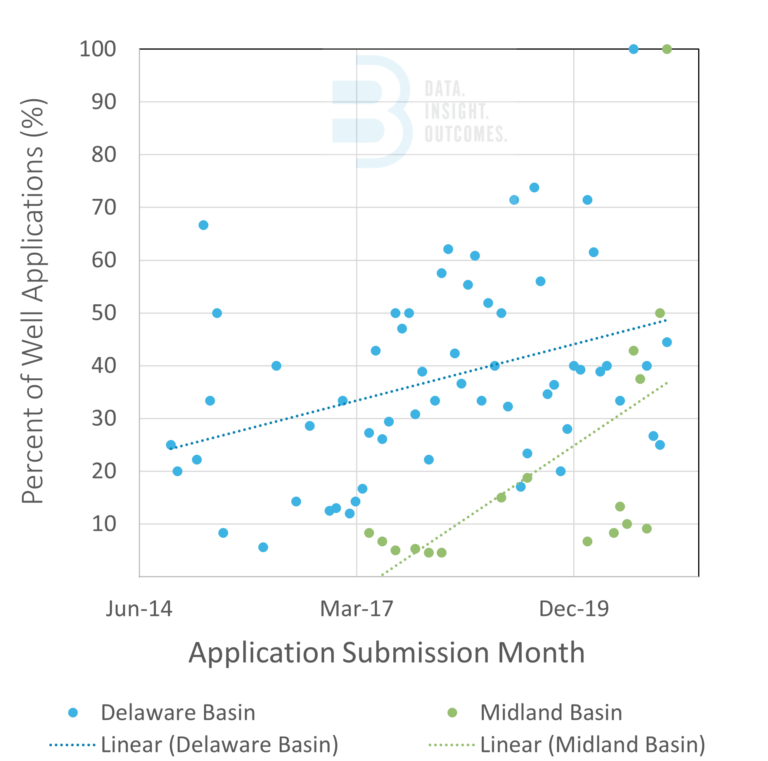

In TX, a continued significant increase in the area affected by M 2.0 earthquakes (as shown in Part 1 of this series) could result in a severe slowdown in the development of new disposal capacity. If a proposed disposal well is located within a 5.64-mi radius of an M 2.0 event, the well application will be subject to potentially time-consuming seismic review. The number of new well applications that have been through the RRC seismic review process has been increasing across the Permian over the past few years (Figure 1). Approximately 34% of all Permian disposal applications now undergo RRC seismic review.

While under seismic review, the applicant must provide additional information to assess the seismic risk of the disposal well, potentially including structure maps, isopach maps, cross-sections, and fault hazard analysis. Seismic review analyses result in a letter grade based on eight seismicity and faulting factors, two operational factors, and three reservoir factors. The resulting disposal well grades each have restrictions and requirements, typically these are reductions in injection rate and pressure and regular data submission (Table 1).

|

Table 1. RRC Letter Grade Requirements |

|||||

|

Letter |

Requirements |

||||

|

Score A |

30,000 bpd |

Daily Records (Volume, Max Pressure) |

Initial Static Hole Pressure Test |

Step Rate Test |

– |

|

Score B |

20,000 bpd |

Daily Records (Volume, Max Pressure) |

Initial Static Hole Pressure Test |

Step Rate Test |

– |

|

Score C |

10,000 bpd |

Daily Records (Volume, Max Pressure) |

Initial Static Hole Pressure Test |

Step Rate Test |

Seismologist Review and Approval (Additional |

Disposal well applications that score a B or C may receive authorization to inject an additional 10,000 bpd if the operator actively implements a seismic monitoring plan that contributes data to an existing public seismic network. Additionally, the operator must develop an earthquake response plan which details operations modifications implemented to mitigate seismic risk and the operator’s threshold for suspension of injection activity. The earthquake response plan is triggered if there is a M 3.5 event within 5.64-mi of a disposal well. Failure to implement an earthquake response plan could result in a requirement from the RRC to submit daily injection volumes and pressures on a monthly cadence for a 5.64-mile radius around shallow injection wells and a 15.5-mile radius around deep injection wells.

Implications for the Bottom Line

The increasing regulatory scrutiny of seismicity near disposal wells is impacting the economics of disposal, as discussed in B3’s recent Market Intel report. Capacity and pressure reductions decrease returns on capital expenditure, and monitoring and mitigation requirements increase operating costs, compounding each other, and degrading disposal well economics. For wells that undergo seismic review, authorized pressure is reduced on average by about 50%, and volume is reduced by about 33%. Pressure is the primary limitation on disposal capacity for almost 50% of wells in the Permian, meaning significant reductions in allowed pressure can dramatically erode the volume a well can inject over time. As in the entire oil and gas industry, economies of scale are fundamental to the continued success of operations. Decreasing allowed injection pressures and rates coupled with expensive monitoring requirements, personnel needs, and review slowdowns will further diminish disposal margins. Economic pressures on disposal in seismically active areas will naturally drive the water management market toward full lifecycle water management, allowing recycling to steer some water volumes away from disposal. The science regarding induced seismicity in the Permian in a matter of ongoing research and debate and a continual ratcheting up of review hurdles will impede disposal development and impact the ability of water managers to support future drilling schedules. Judicious water management companies will work proactively toward partnerships and infrastructure optimization in seismically risky areas, including investing in storage, recycling, and redelivery services to ensure access to an economy of scale and prevent water shortfalls.

Lessons from Oklahoma

Between 2008 and 2015, Oklahoma experienced a 900-fold increase in seismic events. The rise in earthquake activity and magnitude was primarily attributed to increased sub-surface injection of produced water from Oklahoma’s oilfields [1]. By 2016, concerns surrounding the spike in earthquakes led legislators to pass several rules focused on mitigating the effects of subsurface fluid disposal. One rule change significantly restricted the volume of water allowed for subsurface injection in certain counties. Another rule required operators to prove they were not injecting into highly fractured and seismically risky basement rock. These changes impacted around 700 of Oklahoma’s approximately 3,600 disposal wells at the time and decreased the allowed volume in some wells by around 40%. Many of the disposal well operators impacted by these rulemakings were small E&Ps or third-party water management companies. The short time frame associated with the rule makings resulted in an abrupt shake-up of the water management market in Oklahoma.

The takeaway from these events in Oklahoma is that proactive management strategies are necessary to maintain social license to operate and ensure regional health and safety. Many operators have stated in conversation that they are increasing seismic monitoring in risky areas and are continuing to consider additional strategies for water management outside of disposal, including recycling and reuse, in and outside of the oilfield. TX and NM will need to pay close attention to the evolution of seismicity and seismic concerns in the Permian to maintain favorable water management economics and positive public perception in the long run.

[1] Hincks, T., Aspinall, W., Cooke, R., and Gernon, T. 2018. Science. Oklahoma’s induced seismicity strongly linked to wastewater injection depth. https://www.science.org/doi/10.1126/science.aap7911#:~:text=Oklahoma’s%20%E2%88%BC900%2Dfold%20increase,activity%20(1%E2%80%937).