Samantha Fox

Product Manager - Data and Consulting

WATER MANAGEMENT

Proper water management is fundamental to Permian Basin oil and gas production. The production-water management equation has two parts: providing water to drill and complete new wells, and taking flowback and produced water away from the wellhead once production starts. Millions of barrels of water are needed to complete a well on the front end of this equation, but billions of barrels of water are produced on the back end, most of which is disposed underground. As the industry strives toward better water stewardship goals like recycling and beneficial reuse, impacts to disposal options in the meantime can hamstring energy production.

To get a better sense of what those concerning impacts mean, we first need to understand the current disposal capacity in the Permian. Texas’ permit methods (permitting by volume instead of only specifying a limiting pressure) allow us to more readily assess the disposal well capacity, so this thought experiment and discussion are limited to Texas disposal wells. This topic is complex, with several intertwining considerations, which we’ll do our best to address in the following sections.

What is Disposal Capacity?

Capacity encompasses both the volume and pressure of a well, and we use it here to represent the ability of a well to digest a certain volume of fluid (and gas) at a certain pressure. Disposal well capacity can be defined by many potential numbers: permitted, utilized, or operational. State agencies set permitted, or authorized, capacity by specifying barrel per day or pressure limits on disposal well permits. Utilized capacity is the percentage of permitted capacity actually being used by the well operator (for our purposes, a six-month median value). Operational capacity is more complex; we’ve included methodology at the bottom of this article [1].

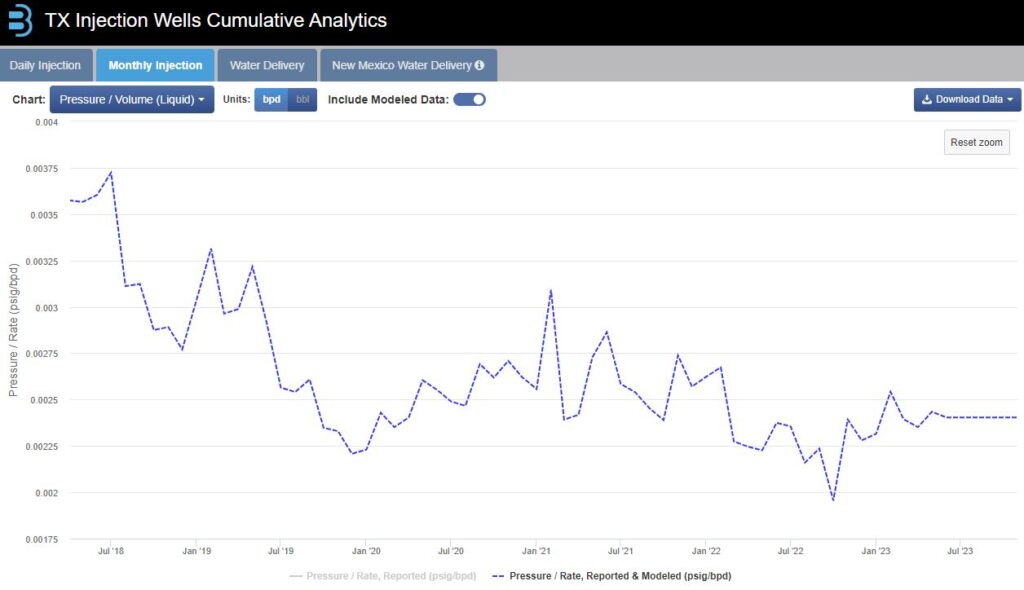

Graph illustrating the cumulative analytics of Texas injection wells, signaling potential water disposal challenges in the Permian Basin. (Source: B3 Insight)

Operational capacity is based on an estimate of daily injection pressure per barrel and the authorized maximum injection pressure. This captures the reality of pressure limitations on disposal wells and provides a more accurate idea of the volume a well can handle. It’s valuable to understand because operational capacity allows us to estimate a well’s ability to reach its permitted volume and pressure based on its past performance. For example, suppose a well is permitted for 30,000 bpd but has been injecting 10,000 bpd at its maximum authorized pressure. In that case, its operational capacity is likely 10,000 bpd, not the permitted 30,000 bpd.

The cumulative permitted disposal capacity for the thousands of actively injecting wells in the TX Permian is estimated to be just over 51 million bpd. However, the operational capacity is only around 31 million bpd, a massive 40% less than permitted capacity. Operational capacity is also about 40% less than permitted capacity in both the Midland and Delaware Basins. This paints a picture of a Permian Basin less able to dispose of its water.

IMPACTS OF CAPACITY REDUCTIONS

On the one hand, this is concerning and makes the runway appear much shorter before we reach disposal limits. On the other hand, there are many nuances to consider here. Two primary factors for capacity considerations are actual utilization and regional distribution. Operators do not always utilize the entire capacity of their disposal wells and are, on average, underutilizing their permitted or operational capacity. “On average” is significant because disposal wells do not necessarily operate 24/7/365, but pressure and injection rate measurements are monthly averages of days when the well may be operating at its injection rate or pressure limits, days when it is not in operation at all, or days with moderate operations. To summarize, utilization certainly adds some footage to the disposal runway. Still, it may not get us clear of the fence at the end of the airstrip.

Secondly, we must consider the regional distribution of capacity. Drastically simplified, the closer a disposal well is to a production well completion, the more likely it is to be used to dispose of that well’s produced water. In core development acreage, disposal wells are already taxed from disposing of water from ongoing drilling activity. In areas with fewer completions, disposal wells are not as likely to be utilized and contribute large volumes of available capacity to the basin-wide capacity estimate. The kicker is that this available capacity is not exactly useful to areas where drilling activity is high, and operators need to dispose of large volumes of water. Producers are, understandably, not interested in moving their water over long distances to reach an available disposal well. These factors provide a more complete picture of disposal capacity in the Texas Permian – and because these factors are not often discussed, capacity is probably less than most operators realize.

SEISMIC ACTIVITY CONSTRAINING CAPACITY: SEISMIC RESPONSE AREAS

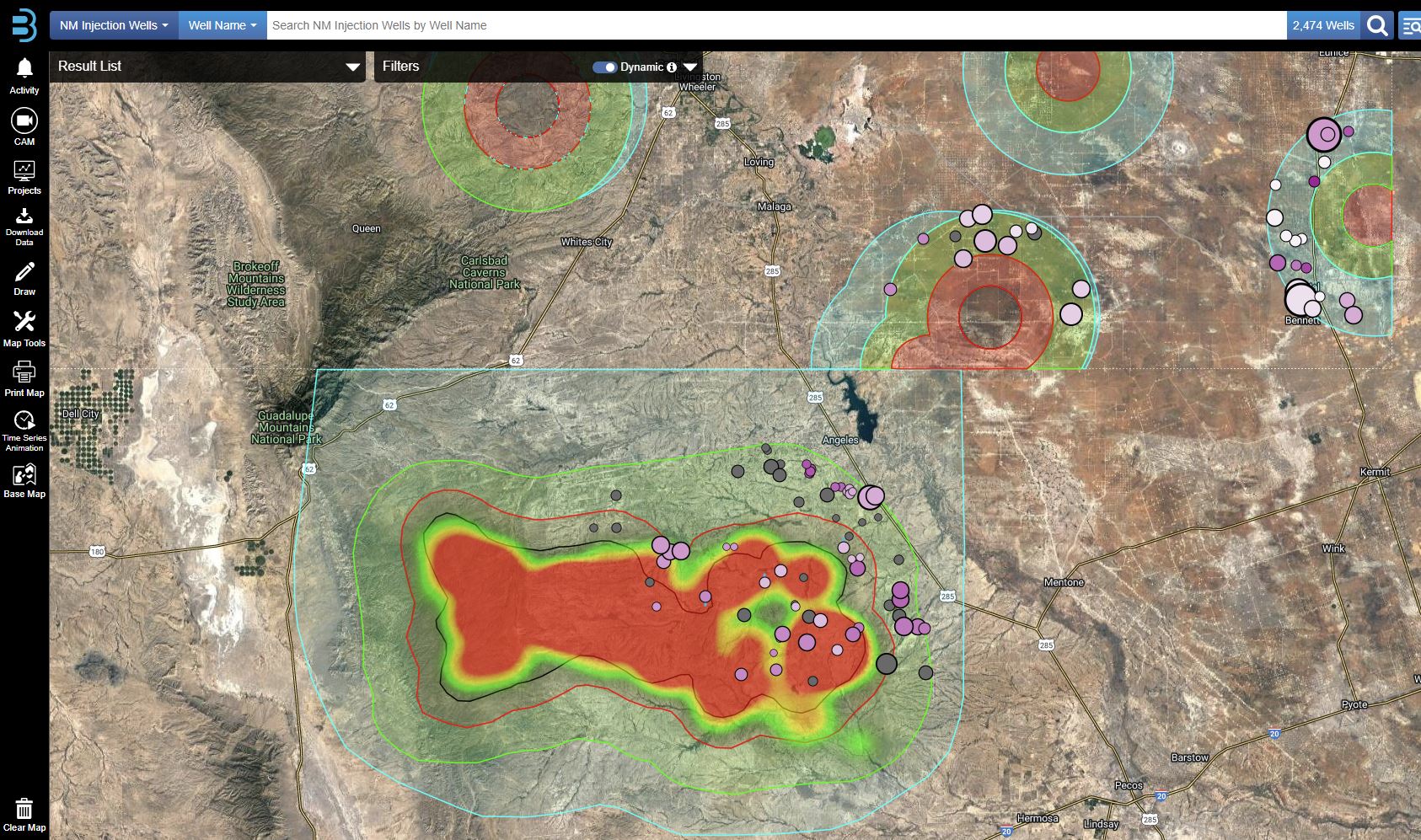

Pictured are New Mexico injection wells within Seismic Response Areas (SRAs), highlighting the evolving regulatory landscape in Texas and New Mexico. (Source: B3 Insight)

In September and October 2021, the Railroad Commission of Texas (RRC) announced the Gardendale and North Culberson-Reeves (NCR) Seismic Response Areas (SRAs). The New Mexico Oil Conservation Division also released guidelines for an SRA in New Mexico along the southern state line on November 23, 2021. Four additional SRAs have followed in southeast NM since then, in 3, 6, and 10-mile radii around significant seismic events. Again, since New Mexico has historically permitted injection wells by pressure, not volumetric rate, we limit this analysis to effects on Texas volumetric capacity.

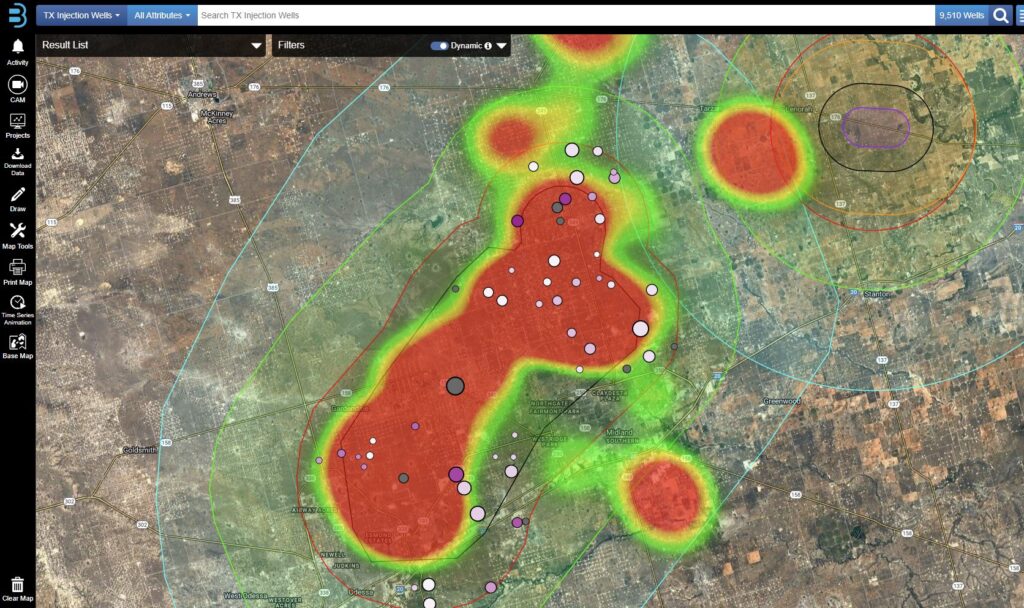

In Texas, the RRC set out guidelines for changes to injection capacity and asked operators to come up with their own plans for how to manage their operations around seismic risk. The requested Operator-Led Response Plans (OLRPs) are expected to address the goal of reducing earthquake activity. The RRC guidance for the Midland Basin Gardendale SRA (and Stanton Seismicity Investigation Region (SIR)) in Texas initially requested a reduction of maximum daily injection to 10,000 barrels per day (bpd) for 76 SWDs, monthly reporting of daily injection volume and pressure, historical daily injection volume and pressure reporting from November 2019 forward, and prevented permitted but unused SWDs from beginning operations. However, another event in December 2022 expanded the Gardendale SRA to include the Range Hill event. RRC shut in deep disposal wells and limited shallow wells to 10,000 bpd if operating. Operators in the Gardendale SRA then developed an OLRP, which created Operator-Led Response Groups (OLRG). The OLRG agreed to keep deep disposal wells shut in. Since the OLRG determined that shallow disposal did not correlate with deep seismicity, they created a plan that allows shallow injection rates to ramp back up to 15,000 bbls/day or max permitted volume, whichever is less, beginning May 2023 if no seismic events M 3.5 or greater happened in the 3 months prior within 9 km of a disposal well. By November 2023, if still no M 3.5 events within 9 km, restrictions on shallow disposal will be removed.

Mapping of Texas injection wells in the Gardendale SRA and Stanton SIR, demonstrating proactive seismic risk management through Operator-Led Response Plans. (Source: B3 Insight)

In the NCR SRA, the RRC requested that operators of 89 wells develop an Operator-Led Response Plan (OLRP). The RRC measure of success is specified as “no more M 3.5 or greater earthquakes after 18 months from implementation” within the NCR SRA. Operators had 90 days to develop, evaluate, and implement the OLRP or the RRC would instead implement its own Seismic Response Action Plan (SRAP), which would have included injection curtailments based on the injection interval depth and proximity of wells to the seismic hotspots in the center of the SRA. The RRC stated that it would continue to review SWD permit applications within the NCR SRA until an OLRP or SRAP was implemented, and if an SRAP was required, no new permits would be approved in the NCR SRA for an unknown period. Operators created an OLRP in March 2022, and in response to a M 5.4 event in November 2022, then further committed to meeting the original deep disposal volume target of 298,000 bpd three months early and meeting a new target of 162,000 bpd by June 30, 2023. As of April 2023, H10 and daily-reported volume in the 25 km NCR SRA averaged 204,000 bpd.

Both SRAs seek to address the potential connection between produced water disposal and induced seismicity in the Permian Basin. The goal is to eliminate significant magnitude seismicity within a year or two by curtailing the amount of water going downhole and decreasing the depth of SWD disposal intervals. The efficacy of the current approach is unclear, given the industry and scientific communities’ evolving understanding of Permian-induced seismicity causes. The estimated reduction of permitted capacity in the Gardendale SRA is about 400,000 bpd. The reduction in the NCR SRA is close to 4 million bpd.

DEVELOPING OUR UNDERSTANDING

As we discussed in the preceding sections, these reductions in disposal capacity could have severe implications on disposal availability. Volume reductions like these assume that the permitted volumes being reduced were available in the first place, which we know could be far from accurate. Additionally, if the RRC or SWD operators decide that more significant volume reductions are needed to address seismicity thoroughly, capacity constraints will be more severe, and water management costs in these areas will rise. In either scenario, if disposal availability decreases or new disposal permitting is limited, the industry should expect water management costs to increase, especially in core Midland Basin and New Mexico acreage. Disposal capacity in the Permian is difficult to confidently assess whether from the perspective of existing operational capacity or even through the lens of total potential disposal capacity. We must continue to develop our understanding of disposal capacity in the Permian and what limiting disposal could do to the ability of the oil and gas industry to produce energy. This understanding will be a key part in infrastructure development strategies, regional capital deployment decisions, and water management plans for E&P companies.

[1] There are over three thousand active disposal wells across the TX Permian; for each of these wells we used a six-month median value for daily injection rate (bpd), injection pressure (psi), and injection pressure per barrel (psi/bbl). Operational capacity was estimated by dividing maximum authorized injection pressure (psi) and by daily pressure per barrel. If daily injection pressure was zero and injection rate was zero, then the operational capacity is the permitted capacity. If daily injection pressure was zero and injection rate was positive, then the operational capacity is the permitted capacity. If daily injection pressure was positive and injection rate was zero then the operational capacity for that well is null. This calculation for operational capacity is based on reported injection pressure which may have limited accuracy based on the quality of reporting or the type of pressure monitoring. Operational capacity is variable and can change over time.