Pat Patton

Commercial Product Manager

“Those that fail to learn from history are doomed to repeat it” – Winston Churchill

The Permian Basin finished 2022 with a shake rather than a bang. On December 12th, Midland Texas shook from a magnitude (M) 5.2 earthquake originating approximately 10 miles north of the city. Seismic events are not uncommon in the Permian Basin, events have been increasing in magnitude and frequency in recent years. Years of water disposal, hydrocarbon extraction, and well stimulation have had an impact on the stability of the ground in the Permian, which now shakes with increasing regularity.

Injection and seismicity are ambiguously linked in the Permian Basin. Induced seismicity, as it is referred to in the Permian, refers to seismic events that are causally related to oil & gas activities. Although it is challenging to identify with complete certainty the cause of increasing seismicity, numerous studies have pointed to water disposal in subsurface formations as a primary culprit. Since the early 2010s the number of seismic events in the Permian has increased tenfold. This coincides with a similar increase in water injection. Prior to 2014, there were only 24 seismic events greater than M3.5 in the Permian Basin. In 2022, there were 60 events above M3.5.

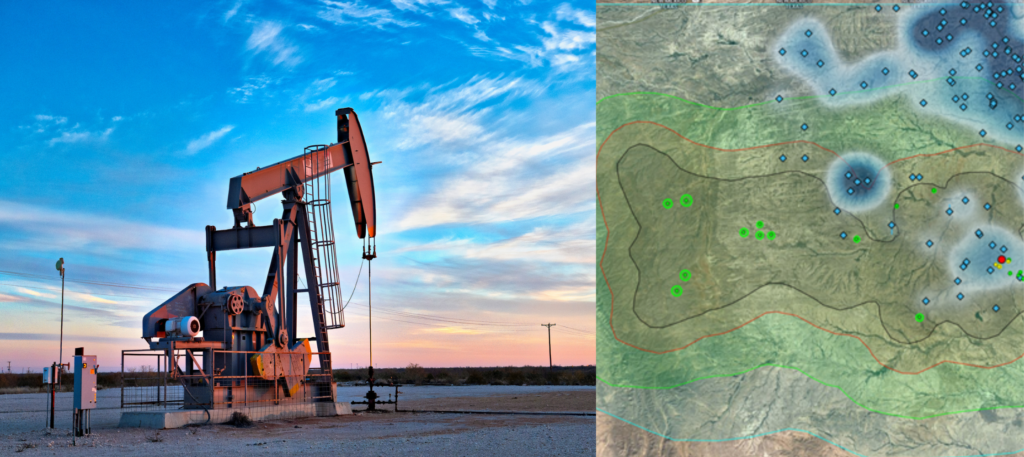

To mitigate increasing seismicity, New Mexico and Texas state agencies recently established disposal restriction areas across the Permian called Seismic Response Areas (SRAs). SRAs were initially established by the Texas Railroad Commission (RRC) in late 2021 as formal requests to saltwater disposal (SWD) well operators to reduce produced water disposal. The goal of the SRAs is to stop induced seismicity by curtailing daily injection volumes at certain SWDs near very seismically active areas. It is unclear whether these measures will have a meaningful impact on seismicity. Early time data does suggest, however, that the prescribed curtailments are reducing seismic events in some SRAs. Effective or not, SRA curtailments have complicated oil and gas operators’ logistics, costs, and water management businesses. Since water disposal is fundamental to hydrocarbon production, seismicity and SRAs now pose a fundamental business risk to oil and gas operators.

When horizontal development in the Permian Basin began to ramp up almost a decade ago, earthquakes were hardly at the forefront of potential challenges that the industry would face in the years to come. Entering 2023, induced seismicity is viewed as the major risk challenging operators.

The new year has begun, and another industry has planted roots and is spreading across the energy landscape. Carbon capture and storage (CCS), fueled by government tax incentives, has begun to emerge as an industry here to stay. To achieve climate goals, and reach net zero in 2050, large scale CCS will be required.

Transporting, injecting, and storing CO2 is orders of magnitude more complicated than injecting oil field produced water waste. So much so that the EPA created a permitting program and well class solely for injection of CO2 – EPA UIC Class VI. The process to obtain an EPA Class VI permit is exhaustive, and the data requirements are infinitely more complex. However, not unlike saltwater disposal, conceptually the process and goal are similar – injection of fluid into a deep geologic reservoir.

Presumably, the same challenge facing the water disposal industry today, will exist in the CCS space in the decades to come. Seismicity. Fundamentally, this is an issue not overlooked by the CCS industry or the EPA. A thorough seismic review is required as a prerequisite before a Class VI injection permit can be issued. However, there are always unknowns and if one lesson can be learned from the Permian it is that the future is always uncertain. It remains to be seen if large multi decade CO2 injection projects will face the same seismicity challenges seen in the saltwater disposal business. Nevertheless, produced water disposal has provided a cautionary tale that should be carefully studied by the emerging carbon capture and storage industry.

EMPOWERING SMART WATER MANAGEMENT

B3 Insight is building the definitive source for water data. We empower smart water management with data-driven intelligence for responsible and profitable decisions about water resources. Whatever your needs, B3 Insight’s OilfieldH2O can positively impact your water management and drilling completions – contact us at [email protected] or 720-664-8517 to learn more.