By Kylie Wright

Part two of our series in which we explore the fundamentals of ESG reporting and its use in the energy and water management sectors.

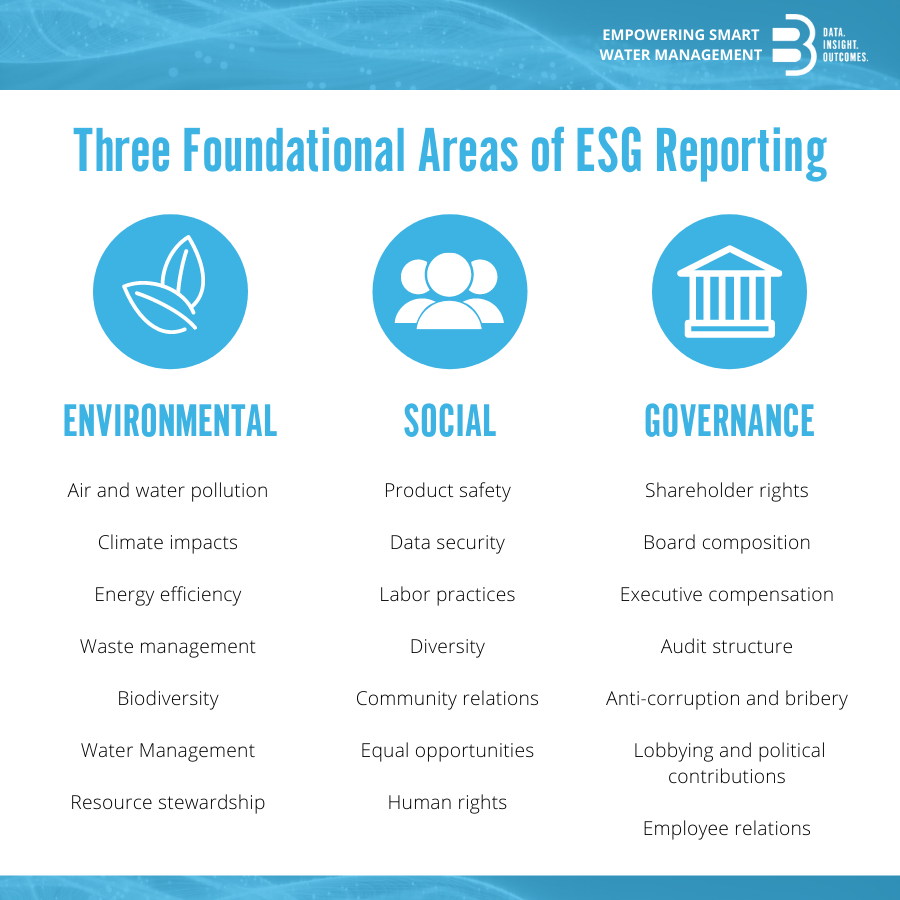

In the first part of this series, we reviewed the background and fundamentals of Environmental, Social, and Governance (ESG) reporting, the definition and metrics of each foundational area, and the use of ESG reporting in the financial industry. Our vision at B3 Insight is to advance the stewardship of water, a foundational resource that underpins nearly every aspect of human activity. It is inherent to our existence yet nearly impossible to understand in a holistic manner. ESG reporting can provide specificity regarding the water and resource stewardship practices of the energy industry and encourages transparency around ESG risks in corporate operations. It is an increasingly important tool for the financial industry and managing risk associated with water in the energy industry will be crucial in the years to come. We believe that innovation is key to creating significant change and our team of experts has spent the last few years working with the industry to create viable solutions for water management and ESG needs. In this installment, we discuss the challenges and opportunities within water-related ESG reporting in the energy industry and how B3 is creating tools and analytics to shed light on ESG risks and opportunities.

The Current State of Water-Related ESG Reporting

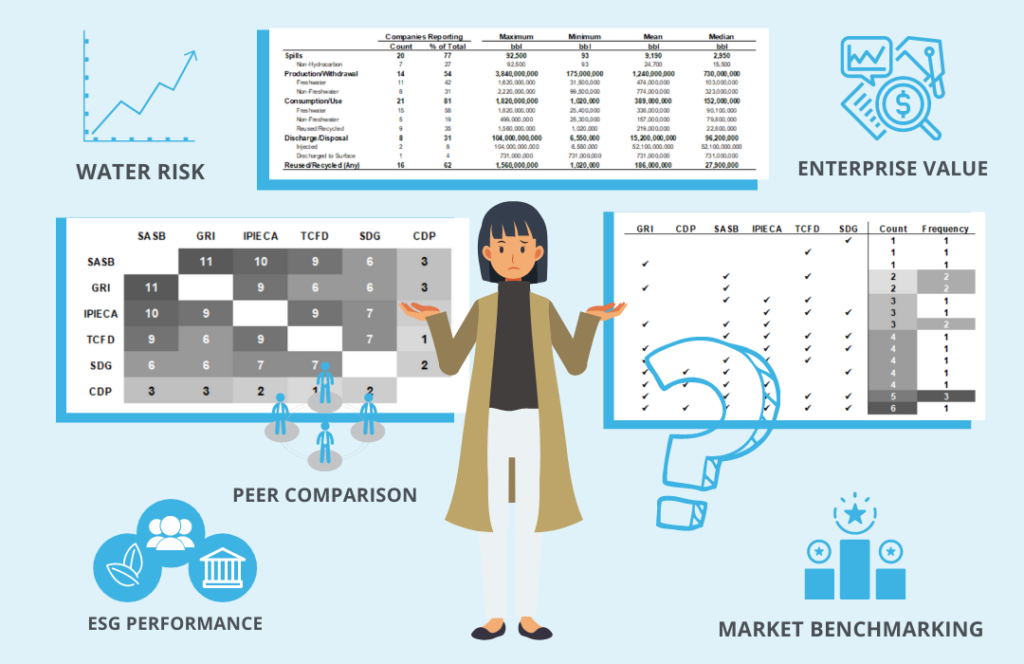

Disclosures related to ESG are still largely discretionary, resulting in a lack of standardization in ESG reporting frameworks. The Sustainability Accounting Standards Board (SASB), the Global Reporting Initiative (GRI), and CDP Worldwide are some of the existing ESG reporting frameworks which can be used to guide corporate ESG reporting, although there are still issues to contend with even when one of these frameworks is used. Use of these frameworks is not mandatory, so two direct competitors can use two different frameworks where specified reporting guidelines and metrics are inconsistent and hard to compare. Unsurprisingly, this yields a large degree of divergence among companies’ reported information. Investors need consistent, relevant, and decision-useful information on which to base their investments, but ESG reporting is currently a grab bag of data. Because the data provided in ESG reporting must be measurable and decision-useful, a “one-size-fits-all” approach to reporting constrains the utility of metrics to inform and convey financial and sustainability goals. This is particularly true in the energy industry, where ESG reporting has only recently been gaining significant attention due to evolving energy policies and global trends including the COVID-19 pandemic and the energy transition.

To assess the state of water-related ESG reporting in the energy industry, B3 analyzed the use of water-relevant ESG metrics in companies with large water management operations in the Permian Basin. As of August 2019, approximately 780 companies were injecting water in the Permian Basin. Of those 780 companies, 140 companies accounted for 95 percent of total Permian Basin water injection, meaning that the remaining 640 companies manage only five percent of total Permian Basin water injection. Twenty-six of those 140 companies included water management-relevant data in annual reporting; those 26 companies are very diverse in size, structure, location, ownership, and services provided and the data included in their reports reflects that diversity. Because the data, including the water-related metrics, provided from company to company varies so wildly, quantitative comparison of management and stewardship is challenging. A standardized set of metrics is necessary to support benchmarking and peer-to-peer comparison by companies and investors as they seek to understand companies’ performance and long-term value relative to the broader market.

B3 – Helping Clients with ESG and Water Management

The Oilfield Water Stewardship Council

The Operator Report

Understanding the market as a whole and your company’s place within it is critical to making informed decisions. Competitive benchmarking illustrates the efficacy of current corporate strategies, highlights areas for improvement, and provides insight into material business risk. Since water risk is business risk and impacts the oil and gas industry in myriad ways – financially, environmentally, operationally, and reputationally – it must be effectively captured and accurately quantified in ESG reporting. Standardized, industry validated, water-relevant ESG metrics are, therefore, an integral part to establishing confident peer-to-peer benchmarking. However, discussions surrounding the ‘E’ in ESG performance are frequently mired in suspicions of greenwashing. As companies strive to participate in the ESG investment boom, investors, regulators, competitors, and the public are at times skeptical of the sustainability claims drifting around the market. Companies in every sector are grappling with transparently proving to all parties that they are operating sustainably. Only through consistent, comprehensive, concise, and clear disclosures can companies truly claim they are worthy of ESG investment.

By using verified, transparent data from a source like B3’s Operator Report, companies can allay greenwashing concerns and confidently present their progress toward ESG goals using quality assured data based on industry supported metrics. The Operator Report includes multiple data driven water-related ESG metrics. Beyond just ESG, the sector-focused data and market assessments provided in the Operator Report can be used to evaluate assets, align capital with investor requirements (and ESG goals), maximize investments, determine targets for acquisition, and compare their performance among peers in areas of interest.

The Future of ESG and Water

Assessing and managing water risk is crucial for the future viability of business operations. A 2019 survey by RBC Global Asset Management found that 67% of over 800 investors surveyed across the world said that water concerns were top of mind, behind only cybersecurity and anti-corruption. In our industry, there is an ongoing shift to holistic water management that incorporates services for every life stage of oilfield water. Recycling and reuse are key water life stages that will be increasingly leveraged during this shift to move water volumes away from riskier management options like disposal. The September 2021 B3 Market Intel Report explores this ongoing transition in the water management industry in more depth.

James P. Bruce, a renowned Canadian hydrogeologist, said it best: “If climate change is a shark, water is its teeth.” Many reporting frameworks fail to give the same level of concern to water as they do climate change. Water, as a vital resource to human life and health, deserves an equal level of attention in ESG reporting moving forward. Developing water-relevant ESG reporting metrics, normalizing a focus on water stewardship, encouraging the shift toward reuse/recycling, and providing transparent water data are just some of the ways B3 is leading the charge for the future of water and ESG.

To Learn More about the B3 market intel report